Describe Methods Used to Calculate Depreciation

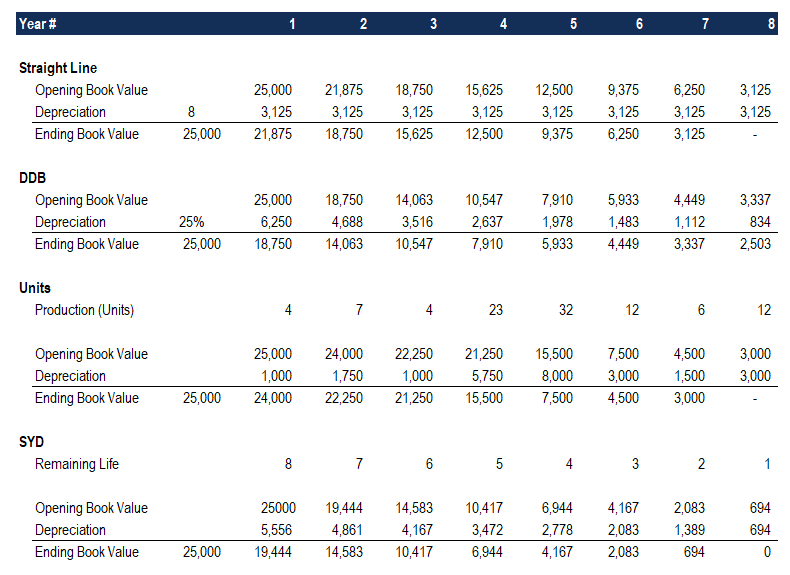

Use an example for each case. Below we will describe each method and provide the formula used to calculate the periodic depreciation expense.

/depreciation-accounting-2ad5d217d7cc49c396f4abfad537f7c2.jpg)

Double Declining Balance Ddb Depreciation Method Definition

A fixed percentage is written off the reduced balance each year.

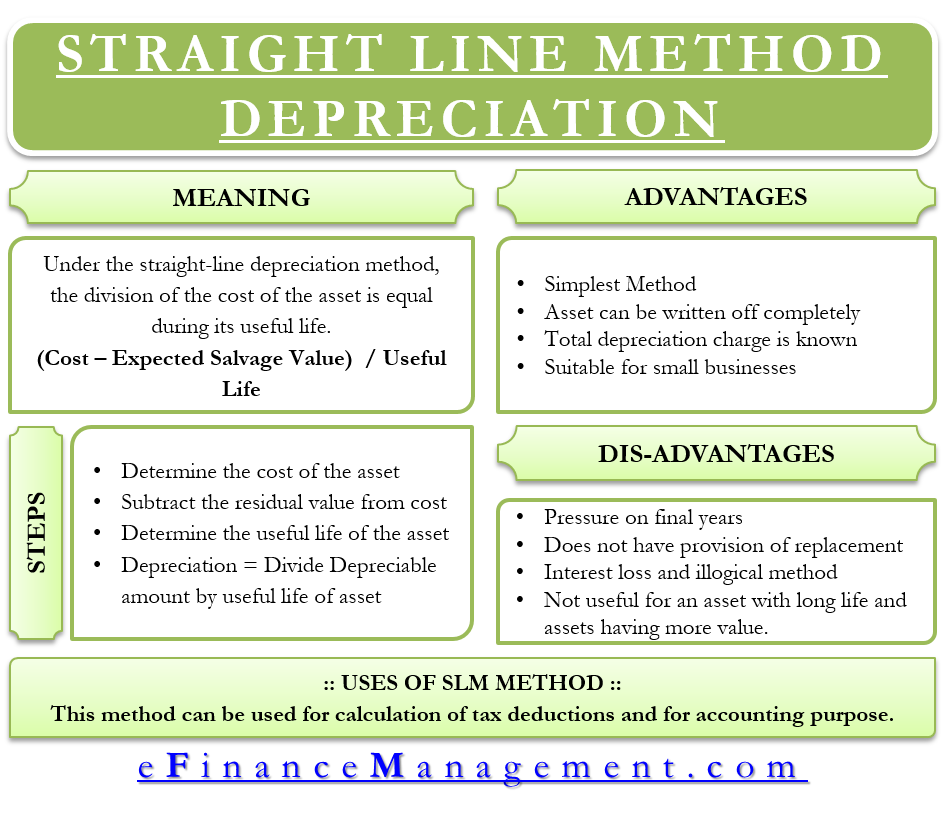

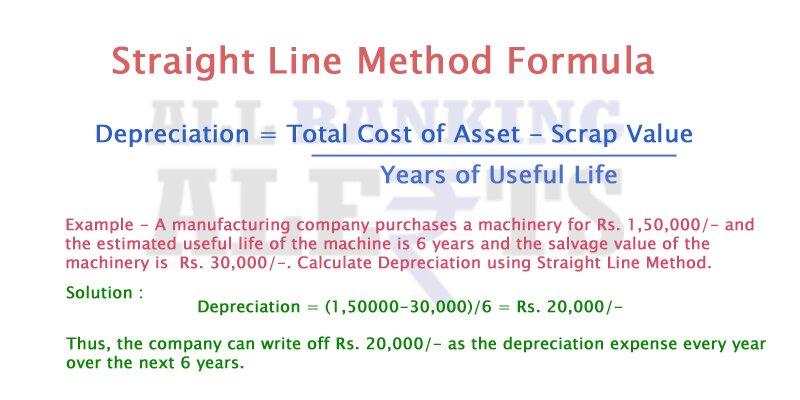

. To calculate depreciation using a straight line basis simply divide net price by the number of useful years of life the asset has. The amount of annual depreciation is computed on Original Cost and it remains fixed from year to year. The expected salvage value is 10000 and the company expects to use the van for five years.

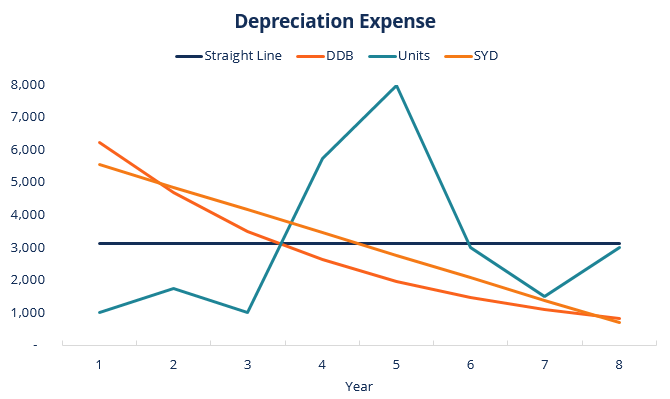

See the answer See the answer See the answer done loading. As a result this method applies higher depreciation expense in the early years and lower depreciation expense in later years. A depreciation method is the systematic manner in which the cost of a tangible asset is expensed out to income statement.

This method is usually used in case of. This type of depreciation method is easy to use and is highly recommended for companies which to calculate depreciation in a simple and effective manner. The first and most straightforward method of calculating depreciation is the straight-line method.

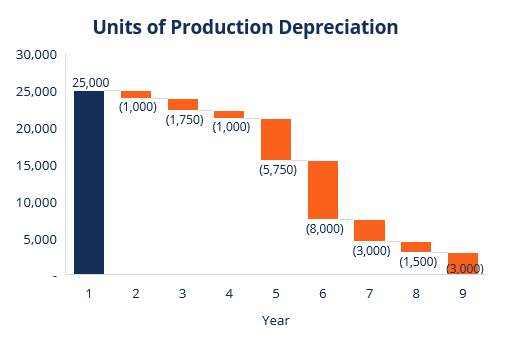

Answers Depreciation is based on the number of hours the machine operated during the period compared to the total expected hours. Use an example for each case. The use of the method is sometimes considered unrealistic because the use of assets is the same every year.

Written Down Value Method. The purpose of depreciation is to match the expense recognition for an asset to the revenue generated by that asset. Thus we calculate depreciation after considering the element of interest.

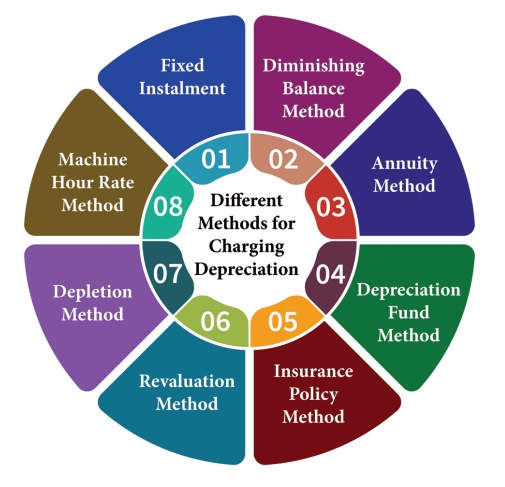

Cost of the asset-residual value nr of years an asset is expected to be used for. The written down value method also known as diminishing balance method or reducing balance. 15 marks 2a Define depreciation and explain four causes of depreciation10 marks b Explain any five methods of calculating depreciation 10 marks Question.

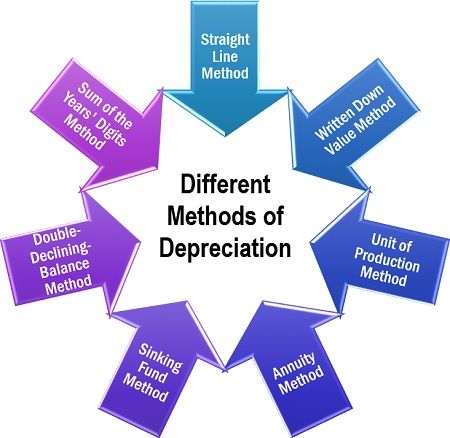

There are different types of depreciation methods such as straight line depreciation reducing balance depreciation sum of the year digit depreciation and units of activity depreciation. This calculation allows companies to realize the loss of value of an asset over a period of time. The two most common methods of calculating depreciation are.

In straight line method of depreciation the same amount of depreciation is charged over the entire useful life of asset such as. By using the formula for the straight-line method the annual depreciation is. Written Down Value Method WDV.

Popular depreciation methods include straight-line method declining balance method units of production method sum of year digits method. N n x n. Depreciation Cost of asset Residual Value x Present value of 1 at sinking fund tables for the given rate of interest.

Each method has its own impact and individual pros and cons. The straight-line method of depreciation is the most simple and easy to use depreciation method. Depreciation is calculated using the following formula.

This is the most commonly used method for the cost of an asset. Depreciation is an accounting method of allocating the cost of a tangible asset over its useful life and is used to account for declines in value over time. Reducing balance method.

Describe the Machine Hour Method of calculating depreciation. Straight-line depreciation is a method of determining the amortization and depreciation of an asset. To calculate it you take annual depreciation Expense equal to the cost of an asset minus its salvage value and divide that by the usefulness of the asset.

The annuity method of. The cost is divided by the number of estimated years of use. This is because engine performance is generally.

This method is also known as the Original Cost method or Fixed Instalment method. Where sum of years 1 2 3. To perform this strategy youll need to estimate the fair lifespan of the assets functionality in years and the salvageable value at the very end of this period which is how much its worth at the end of its usable life.

Straight line basis is calculated by dividing the difference between an assets cost and its expected salvage value by the number of years it is expected to be used. For tax MACRS is the relevant depreciation method. Straight Line Method SLM Under the depreciation Straight Line Method a fixed depreciation amount is charged annually during the lifetime of an asset.

This is called the matching principle where revenues and expenses both appear in the income statement in the same reporting period thereby giving the best view of how well a company has performed in a given reporting period. This method is used to calculate depreciation costs on production machines. The second method of calculating asset depreciation is the declining balance method.

Under the sum-of-the-years digits SYD method depreciation expense is based on a decreasing fraction of depreciable cost. The numerator decreases year by year but the denominator remains constant. A certain percentage can also be given to calculate straight line depreciation on cost.

Describe the three most common methods of computing depreciation for fixed assets and the factors used in calculating depreciation This problem has been solved. Depreciation is charged evenly for all the years. CName and briefly describe three different methods of calculating depreciation.

Straight line depreciation is when the value of an asset is reduced uniformly over each period until it reaches its salvage value.

Depreciation Methods 4 Types Of Depreciation You Must Know

Depreciation Methods 4 Types Of Depreciation You Must Know

Depreciation Formula Examples With Excel Template

Depreciation Definition Types Of Its Methods With Impact On Net Income

What Is Depreciation Types Examples Quiz Accounting Capital

Depreciation Methods Principlesofaccounting Com

Depreciation Methods 4 Types Of Depreciation You Must Know

Methods To Calculate Property Depreciation Building Costing And Estimation Civil Engineering Projects

Depreciation Expense Double Entry Bookkeeping

Different Methods Of Charging Depreciation Auditing

Understand How To Calculate Depreciation Using The Straight Line And Reducing Balance Methods Youtube

Straight Line Depreciation Efinancemanagement

Straight Line Depreciation Formula Guide To Calculate Depreciation

Annuity Method For Calculating Depreciation Qs Study

Different Methods Of Depreciation Definition Factors The Investors Book

Written Down Value Method Of Depreciation Calculation

Depreciation Methods 4 Types Of Depreciation You Must Know

Depreciation Formula Calculate Depreciation Expense

What Is Depreciation Definition Methods Formula To Calculate Depreciation

Comments

Post a Comment